Buy Now, Pay Later

Same Debit Card, More Flexible Payments

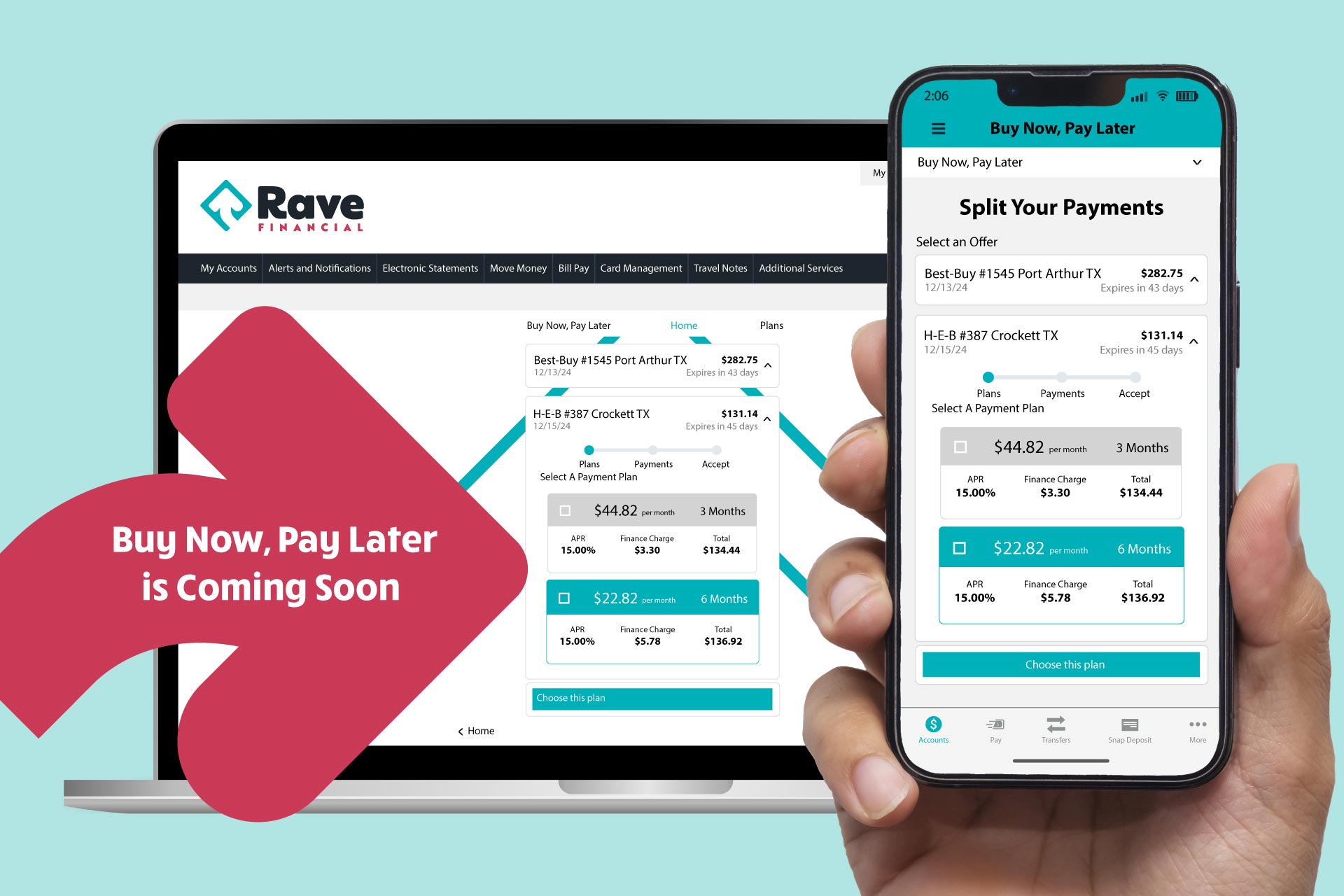

Rave Financial Credit Union is excited to offer our Buy Now, Pay Later (BNPL) option for eligible members with a checking account! This feature allows you to split purchases you’ve already made with your debit card, into easy-to-manage, smaller, monthly payments to help manage your cash flow and stay within budget. Here’s how it works:

Getting Started

- • Make purchases with your debit card.

- • Check Buy Now, Pay Later in your Digital Banking dashboard.

- • On desktop, go to the "Additional Services" tab.

- • On mobile, go to the "More" tab.

- • Click the "Buy Now, Pay Later" option.

- • On desktop, go to the "Additional Services" tab.

- • View available offers on eligible purchases.

- • Decide which purchases you would like to split over time.

- • Select the installment plan that works for you.

- • See your purchase amount deposited back into your account within 24 hours.

You’re already qualified.

- No credit check.

- No application. Your BNPL offers are tailored for you and are pre-qualified. Simply view and accept to proceed.

- No new cards or accounts are required. Continue using your existing Rave Financial checking account and debit card when accessing BNPL offers.

- Everything in your online banking. Review and manage your BNPL offers, plans, and payments in one place.

Frequently Asked Questions

Where can I find my BNPL offers? BNPL offers are found in Rave Financial Credit Union's Digital Banking. To access your BNPL offers, on desktop go to the “Additional Services” tab, on mobile go to the “More” tab. Under the dropdown, you will select the “Buy Now, Pay Later” option.

How do I apply for a BNPL loan? There is no application for a Rave Financial Credit Union loan. All Split Your Payment and Plan Your Purchase BNPL offers found within your Online Banking are pre-qualified for you to view and accept. You will receive a copy of the loan agreement in your email.

How soon will I see my purchase amount deposited back into my account? After accepting a Rave Financial Credit Union BNPL offer, your purchase amount will be deposited into your account in moments. In some cases, it can take up to 24 hours.

Does BNPL require a credit check? No, Rave Financial Credit Union's BNPL offering does not require a credit check.

Can I pay off my BNPL plans early? Yes. You can pay off your BNPL plans early within your Rave Financial Credit Union Online Banking or at an experience center.

Why can't I see any BNPL offers? If you do not see any BNPL offers, this may be because your current account status is not eligible for BNPL. If you already have active BNPL plans, you may not be eligible for additional offers until the active plans are paid back.

If you do not see Split Your Payment offers, this may be because your recent debit card purchases are not eligible for BNPL.

What makes a purchase eligible for Split Your Payments offers? A purchase eligible for Split Your Payments is a debit card purchase made in the past 60 days that is at least $100 and was not a cash equivalent purchase (e.g. ATM withdrawal, money order, cash advance, etc.) Other restrictions surrounding the merchant type and transaction limits may affect BNPL eligibility.

Subject to approval. Member must have a checking account. Member's eligibility is determined by account relationship, including: average deposits, average daily balances, outstanding loans, existing repayment behavior, and insufficient funds history. For Debit card purchases to qualify they must be recent, within the approved dollar amount range, and made at a qualifying merchant category type. See credit union for more details.